- Bitcoin fell as much as 4% on Tuesday after SEC Chairman nominee Gary Gensler testified that he would seek to eliminate fraud and manipulation from crypto markets.

- Gensler said that the investor protections the SEC seeks to enforce should ensure that crypto markets are “free of fraud and manipulation.”

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

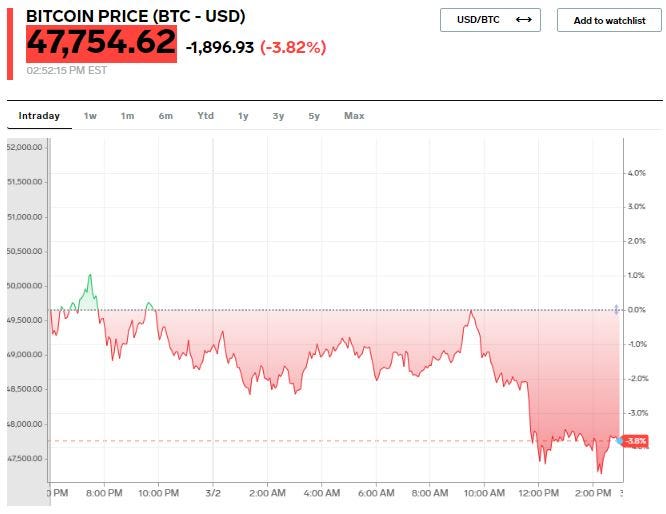

Bitcoin shed as much as 4% on Tuesday following Senate testimony from President Joe Biden’s nominee for Chairman of the Securities and Exchange Commission, Gary Gensler.

Gensler said that the SEC would seek to enforce investor protections in the crypto market, including ensuring that the custody of digital assets are safe and seeking to eliminate fraud and manipulation from cryptocurrency markets.

The SEC must ensure that crypto markets “are free of fraud and manipulation, and I think that’s the greater challenge, frankly, because some markets, usually operating overseas, have been rife with fraud,” Gensler said.

Bitcoin traded just below $50,000 Tuesday morning, before falling to $47,190 as of 2:15 p.m. Gensler has been viewed as an advocate for cryptocurrencies, given his past work and teachings on the subject at MIT.

Despite the decline on Tuesday, bitcoin is still up more than 60% year-to-date.